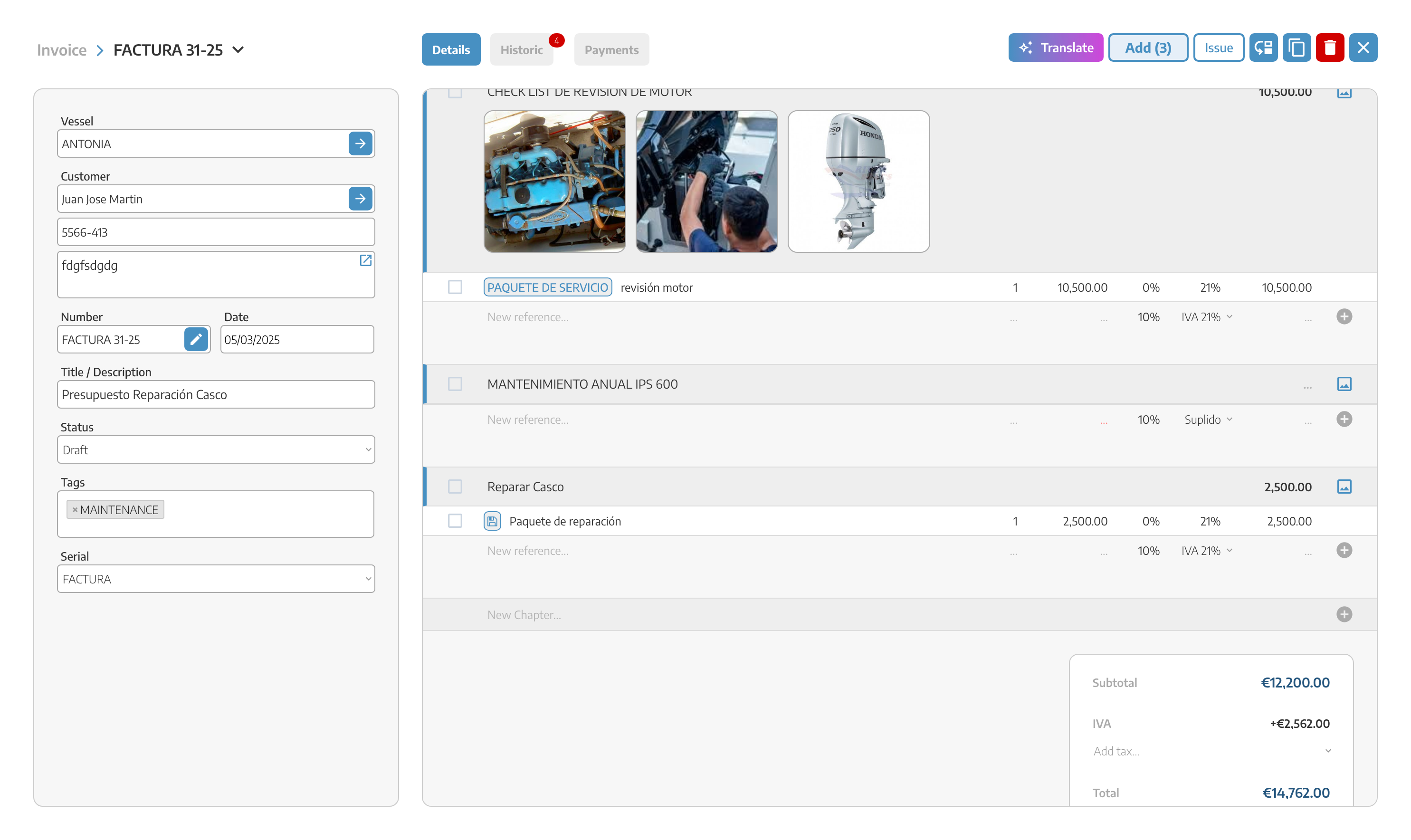

To include a SUPPLEMENT which is an expense that has been carried out on behalf of the client and they have to return the money paid on their behalf without the invoice being in the name of our yacht, we will make the selection on the line of that cost as SUPPLEMENT.

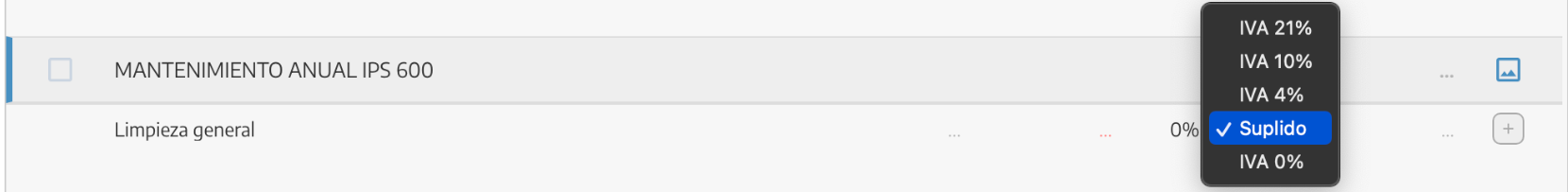

Once the concept of the line has been loaded in the document when selecting the applicable VAT rate, we will indicate that this line is a Supplement.

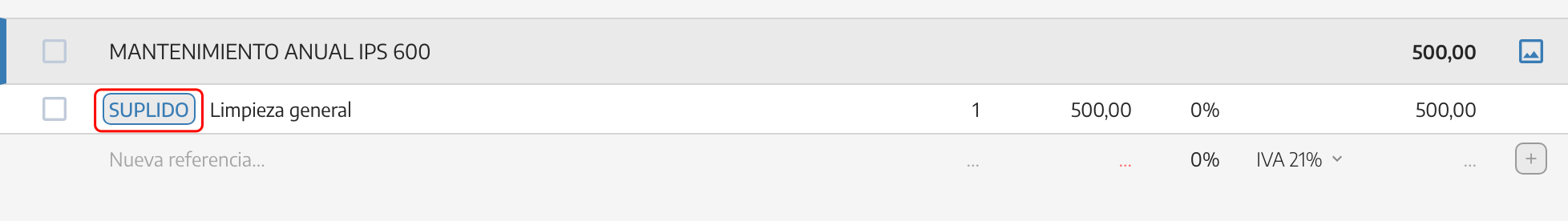

At that moment a watermark will be generated in the tax box as Supplemented and the amount will be accumulated in the final summation without affecting the TAXABLE BASE and cannot be recorded for more taxes applicable to said taxable base.

In the final summary table of the document you will see this amount broken down as SUPPLIED being added to the TOTAL amount but not being affected in the taxable base by other taxes applicable to this taxable base.