In order for StarNapp to calculate the cost and benefit of labor, it is necessary that we indicate the cost of an employee.

To do this we will make a calculation based on the total cost of the operator's company that appears in the TC-2 or you can consult your agency and divide that cost by the monthly hours worked, usually 160 hours. To the resulting amount we add a 30% margin that corresponds to materials, tools and/or cost of uniforms, etc.

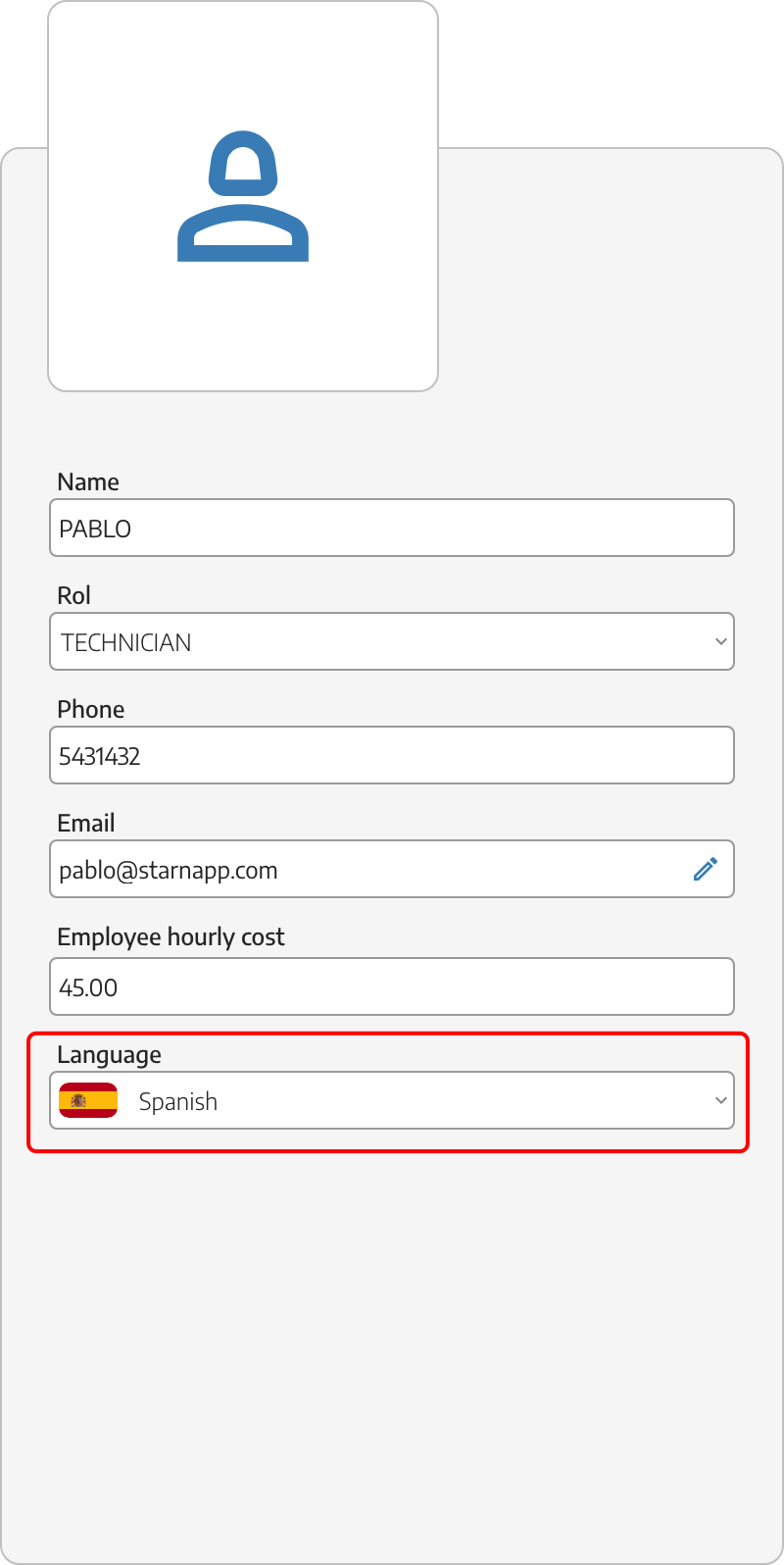

To add this cost we go to the option EMPLOYEES / PROFILES. Now we select the employee we want to include or modify its cost. Here we indicate his cost price and his job category.

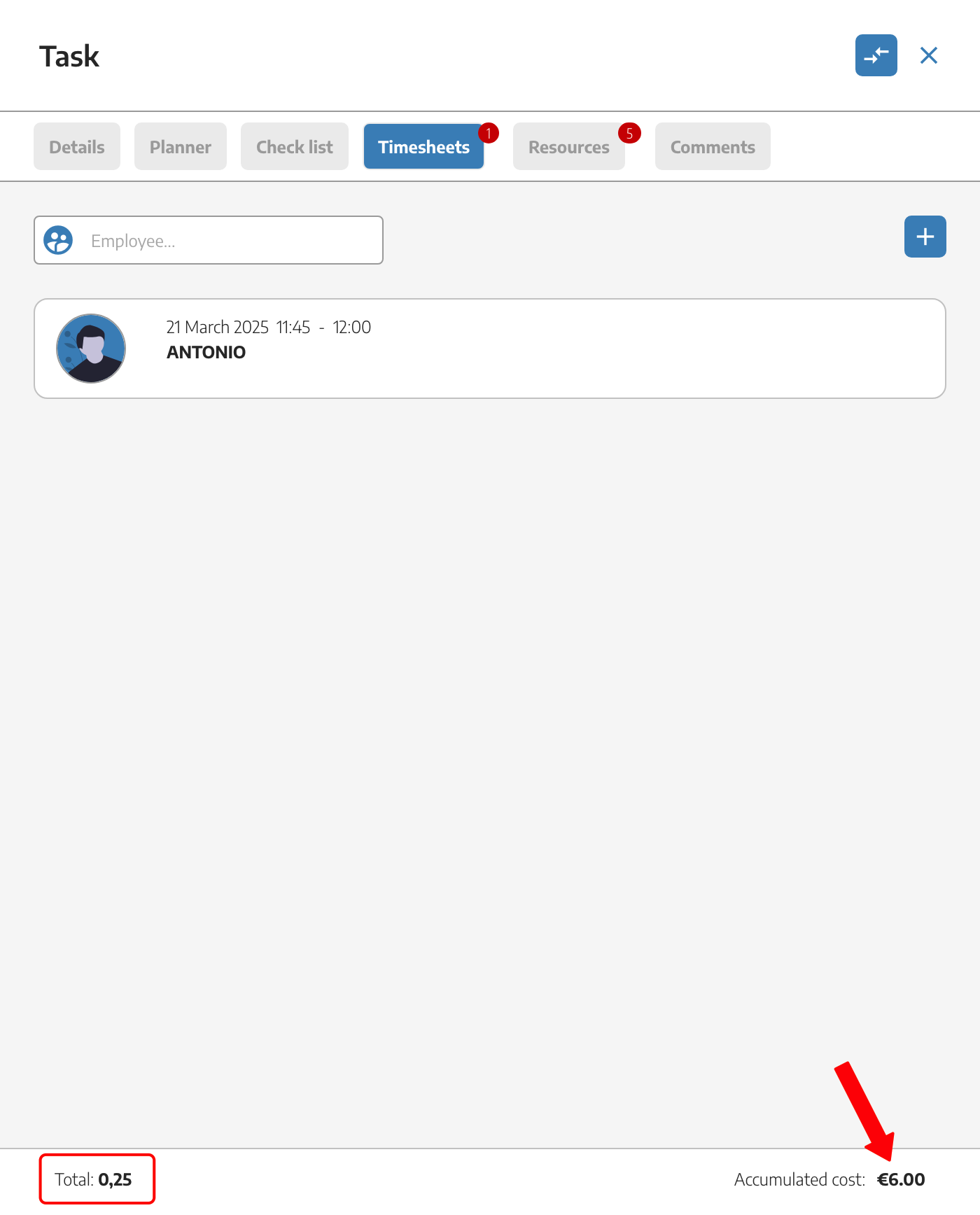

The result once changed is that StarNapp will calculate in any estimate, Work Order, Delivery Note or Invoice the imputed Labor costs by discounting the cost to the company and the selling price of the labor, which will make the “donut” effective in your costing and expected profit.